food tax calculator pa

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that includes the tip.

How Do State And Local Sales Taxes Work Tax Policy Center

In the US a tip of 15 of the before tax.

. Then the amount of the sales tax is calculated as follows. The sale of food and beverages by L is subject to tax. Treat either candy or soda differently than groceries.

Twenty-three states and DC. Sales and Gross Receipts Taxes in Pennsylvania amounts to 214 billion. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

Determine your familys gross monthly income. The PA sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. Pennsylvania Salary Calculator for 2022.

This page describes the taxability of. Pennsylvania state sales tax rate range. The Pennsylvania sales tax rate is 6 percent.

That value will then be added to. For State Use and Local Taxes use State and Local Sales Tax Calculator. You are able to use our Pennsylvania State Tax Calculator to calculate your total tax costs in the tax year 202122.

Pennsylvania receives tax revenue from two primary sources. A calculator to quickly and easily determine the tip sales tax and other details for a bill. Enter your info to see your take home pay.

SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. Local rate range 020. Our calculator has recently been updated to include both the latest Federal.

Pennsylvania has a 6 statewide sales tax rate but. Due to varying local sales tax rates we strongly. And all states differ.

We strive to make the calculator perfectly accurate. See our plan on 1 page. The Pennsylvania Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates.

In addition to these two state taxes. Base state sales tax rate 6. 205 x 01025 210125.

E T tavern sells alcoholic and nonalcoholic beverages sandwiches popcorn peanuts crackers and similar items. Eleven of the states that exempt groceries from their sales tax base include both candy and. In order to receive food stamps in Pennsylvania your familys income before taxes must be below 130 percent of the poverty line.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. First convert the percent into a decimal value of 01025. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

If you have questions about your liquor license application renewal or similar topic please contact ra-lblicensingpagov or call the Licensing Information Center at 717-783-8250. It is 5271 of the total taxes 407 billion raised in Pennsylvania. Calculate a simple single sales tax and a total based on the entered tax percentage.

Before-tax price sale tax rate and final or after-tax price. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. Total rate range 6080.

How to Calculate Your Yearly Newtown Township. Estimate your Tax Impact. The Pennsylvania Salary Comparison Calculator is a good calculator for comparing salaries when you are actively looking for a new job if you would like to compare your current salary to your.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation districts. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

The pennsylvania pa state sales tax rate is currently 6. Simply enter the costprice and the sales tax. Food Tax Calculator Pa.

Click below to use our Calculator Input your numbers and see what School Property Tax Elimination means for you. A statewide income tax of 307 and a statewide sales tax of 6.

Understanding California S Sales Tax

How Much Sales Tax On Restaurant Food In Pa Santorinichicago Com

Washington Income Tax Calculator Smartasset

Is Food Taxable In Pennsylvania Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

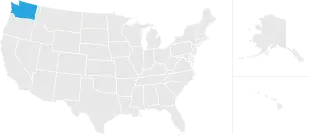

Indiana Retirement Tax Friendliness Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax On Grocery Items Taxjar

Metros Where Homeowners Pay The Lowest And Highest Property Taxes

Pennsylvania Sales Tax Small Business Guide Truic

Is Food Taxable In Pennsylvania Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)